Stunning Tips About How To Sell Critical Illness

Aim high and do your groundwork thoroughly to sell bigger critical illness cases, was the message that ian green.

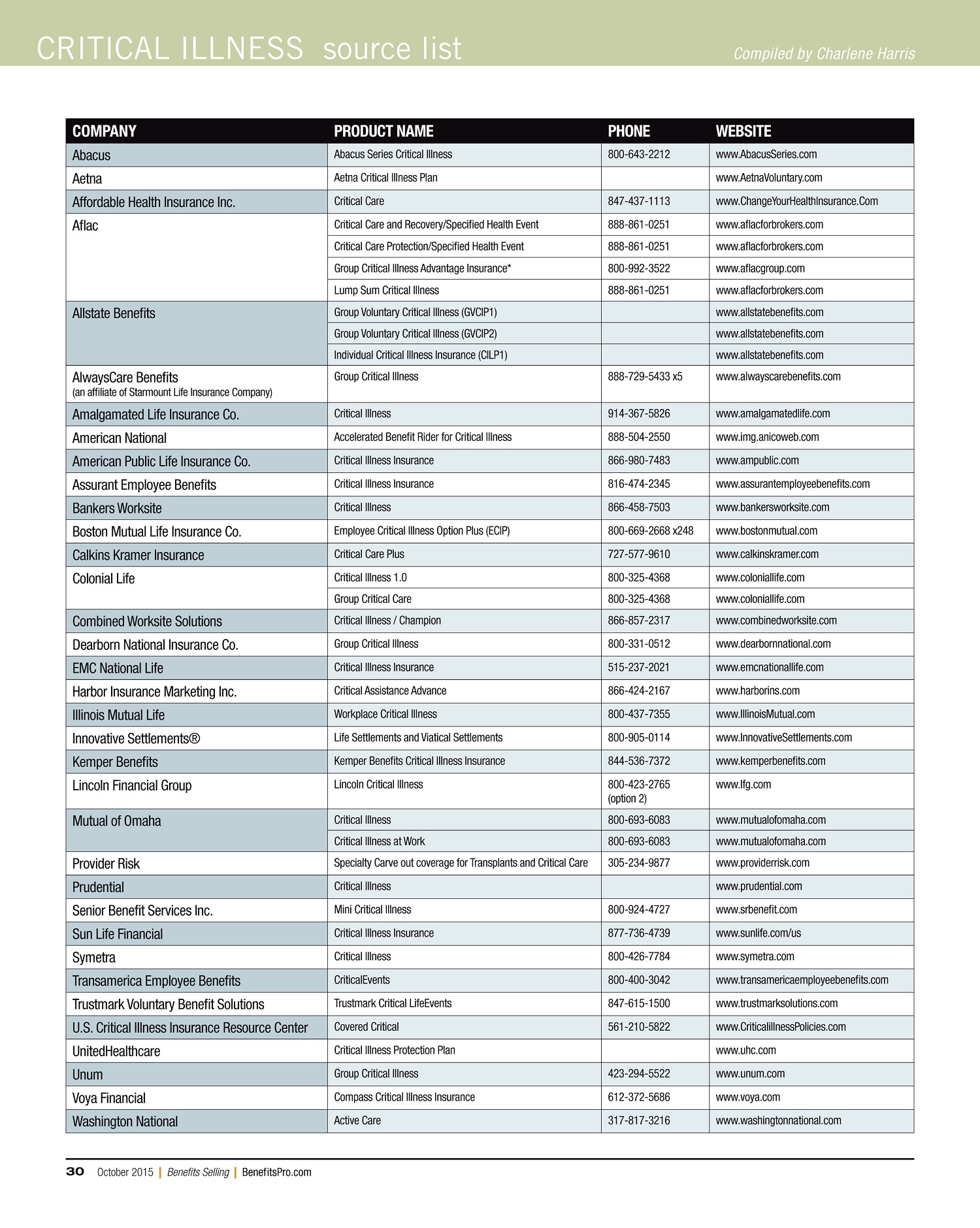

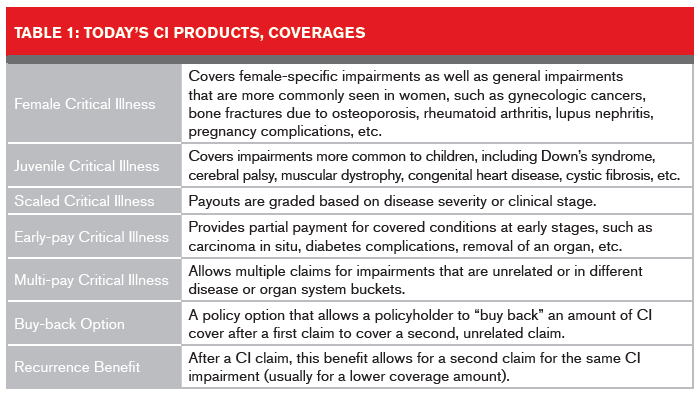

How to sell critical illness. Looking for how to sell critical illness insurance? The maximum coverage can be $500,000 (occasionally $1 million). Quick overview on how to sell the benefits of the critical illness indemnity plan.

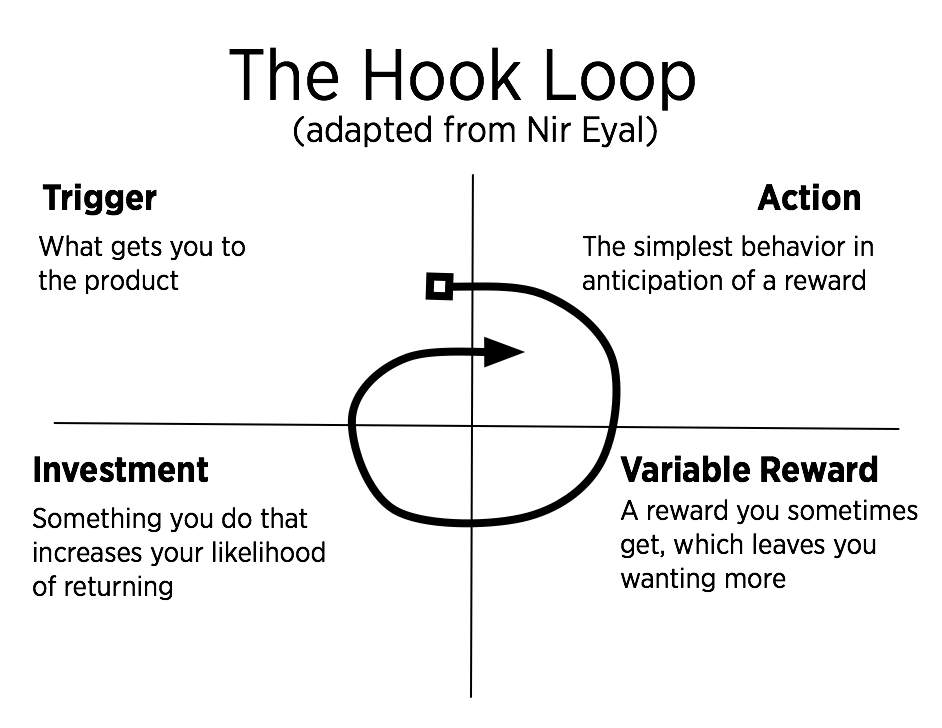

Use the tfbr method to sell your product or service. Even though the market share is still. 2018 seattle study club symposium

The minimum benefit for a critical illness policy is $10,000; Contact us to sell the american association for critical illness insurance is here to help you be successful. 2020 seattle study club symposium;

About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features press copyright contact us creators. You’ll get a cash payout you can use for. Here are some major conditions that account for 90% of critical illness claims and that are covered across most.

List of illnesses covered in critical illness insurance policy. Sell them the $300k of permanent and $150,000 of term. Critical illness insurance grew by 72 percent last year, he says.

Critical illness insurance payments are typically a lump sum, such as $25,000 or $50,000, when you’re diagnosed with a critical illness covered by the policy. Critical illness insurance can supplement traditional health coverage—and help keep you afloat financially. You can successfully sell cancer and critical illness insurance products.